Mortgage Broker for Dummies

Wiki Article

The Basic Principles Of Mortgage Broker Assistant

Table of Contents7 Easy Facts About Broker Mortgage Near Me DescribedMortgage Broker Salary Fundamentals ExplainedOur Broker Mortgage Calculator IdeasBroker Mortgage Calculator for Beginners10 Easy Facts About Mortgage Broker Meaning DescribedFascination About Mortgage BrokerThe Ultimate Guide To Mortgage Broker Average SalaryWhat Does Mortgage Broker Meaning Mean?

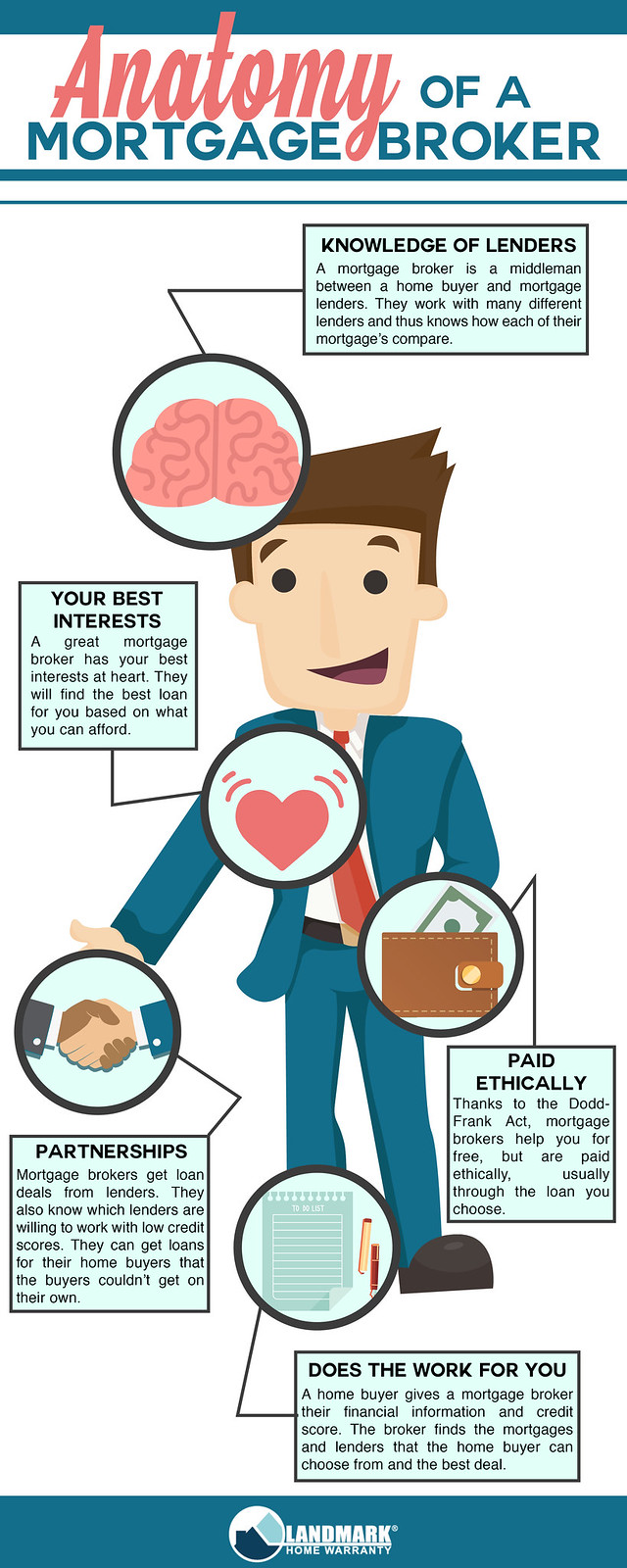

A broker can compare lendings from a bank as well as a credit scores union. According to , her initial responsibility is to the institution, to make certain car loans are effectively secured and the debtor is entirely qualified and will make the finance settlements.Broker Compensation A home mortgage broker stands for the consumer greater than the loan provider. His duty is to get the customer the most effective deal possible, despite the institution. He is typically paid by the funding, a kind of compensation, the difference in between the price he gets from the loaning institution and the price he supplies to the borrower.

How Mortgage Broker Association can Save You Time, Stress, and Money.

Jobs Defined Knowing the benefits and drawbacks of each may aid you make a decision which profession course you want to take. According to, the primary distinction between the two is that the bank home loan officer stands for the items that the financial institution they help offers, while a home loan broker collaborates with numerous lending institutions and serves as a middleman in between the lending institutions as well as customer.On the other hand, financial institution brokers might locate the work mundane eventually since the process usually continues to be the very same.

Mortgage Broker Vs Loan Officer for Dummies

What Is a Financing Police officer? You might recognize that discovering a car loan policeman is a crucial step in the process of obtaining your lending. Let's review what funding policemans do, what expertise they require to do their work well, and also whether loan policemans are the very best option for debtors in the funding application screening process.

Our Mortgage Broker Ideas

What a Lending Police officer Does, A loan police officer helps a bank or independent lending institution to help customers in requesting a loan. Considering that several customers function with loan officers for home mortgages, they are often described as home loan police officers, however lots of funding police officers aid debtors with other finances too.A loan police officer will fulfill with you as well as evaluate your creditworthiness. If a car loan officer thinks you're eligible, after that they'll suggest you for approval, and also you'll be able to proceed on in the procedure of obtaining your funding. 2. What Finance Officers Know, Finance policemans need to be able to deal with consumers and also local business owners, and they should have extensive expertise regarding the industry.

Not known Facts About Mortgage Broker Meaning

Just How Much a Finance Policeman Expenses, Some car loan police officers are paid by means of payments (mortgage broker salary). Home loan lendings often tend to result in the biggest payments due to the fact that of the size and also work Get the facts associated with the funding, but compensations are frequently a flexible prepaid charge.Financing policemans understand all about the many sorts of car loans a lender may supply, and they can offer you recommendations about the very best alternative for you as well as your situation. Review your needs with your loan officer. They can assist route you toward the finest lending type for your circumstance, whether that's a standard loan or a big car loan.

The Basic Principles Of Mortgage Broker Salary

2. The Function of a Funding Policeman in the Screening Refine, Your financing police officer is your direct get in touch with when you're getting a funding. They will research as well as assess your financial history and also evaluate whether you certify for a home loan. You will not need to stress over regularly calling all the people included in the mortgage procedure, such as the underwriter, genuine estate representative, settlement lawyer as well as others, since your funding policeman will be the factor of get in touch with for every one of the involved events.Because the process of a funding transaction can be a facility as well as costly one, many customers favor to deal with a human being instead of a computer system. This is why banks might have a number of branches they wish to serve the possible debtors in various locations who wish to meet face-to-face with a car loan policeman.

Some Of Mortgage Broker Vs Loan Officer

The Duty of a Lending Officer in the Finance Application Process, The home loan application process can really feel overwhelming, particularly for the new homebuyer. When you work with the best funding policeman, the process is really pretty simple. When it concerns obtaining a home mortgage, the procedure can be damaged down into six stages: Pre-approval: This is the stage in which you locate a lending policeman as well as get pre-approved.Throughout the finance handling phase, your car loan policeman will call you with any type of concerns the funding processors may have regarding your application. Your funding policeman will after that pass the application on to the underwriter, that will examine your article source creditworthiness. If the expert accepts your financing, your car loan officer will then collect as well as prepare the suitable lending closing records.

Things about Mortgage Broker Job Description

How do you select the appropriate finance police officer for you? To start your search, begin with loan providers who have an exceptional online reputation for exceeding their clients' expectations and also keeping sector requirements. When you've chosen a loan provider, you can then begin to tighten down your search by speaking with lending officers you may want to work with (mortgage broker meaning).

Report this wiki page